H.R. 1662: Leveraging and Energizing America’s Apprenticeship Programs Act

The Leveraging and Energizing America’s Apprenticeship Programs Act (LEAP Act) aims to amend the Internal Revenue Code to establish a tax credit for employers who have employees participating in qualified apprenticeship programs. Here is a breakdown of the main provisions of the bill:

Tax Credit for Employers

The bill proposes that employers can receive a tax credit of $1,500 for each "apprenticeship employee" beyond a certain average number of such employees over the previous three years. This credit is available for a maximum of two years for each apprenticeship employee.

Definition of "Apprenticeship Employee"

An "apprenticeship employee" is defined as an employee who:

- is employed in a recognized apprenticeship occupation as determined by the Department of Labor, and

- is currently enrolled in a registered apprenticeship program.

Apprenticeship Program Criteria

An "apprenticeship program" must be one that is officially registered with the Department of Labor, indicating that it meets specific standards.

Applicable Apprenticeship Level

The applicable apprenticeship level for calculating the credit is determined by taking 80% of the average number of apprenticeship employees over the past three years. If an employer has no prior apprenticeship employees in those years, this number is set to zero.

Restrictions on Certain Industries

Employers in certain sectors, particularly those categorized under industry code 23 (construction), may face limitations on claiming the credit unless specific conditions are met. These conditions include that the employee must be a pre-apprenticeship graduate and the employer must participate in or sponsor an apprenticeship program.

Coordination with Other Tax Credits

The bill includes provisions to ensure that the apprenticeship credit does not lead to double benefits with other tax credits. Specifically, the amount the employer can claim under other sections will need to be reduced by the amount received from the apprenticeship credit.

Implementation Timeline

The amendments are set to apply to individuals starting apprenticeship programs after the bill is enacted, suggesting a focus on future apprenticeship opportunities.

Cost Reduction Measures for Government Printing

In addition to the apprenticeship provisions, the bill includes requirements for government agencies to minimize printing costs by making publications available online and devising strategies to cut overall government printing expenses, ensuring that essential printed documents remain accessible for populations with limited internet access.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

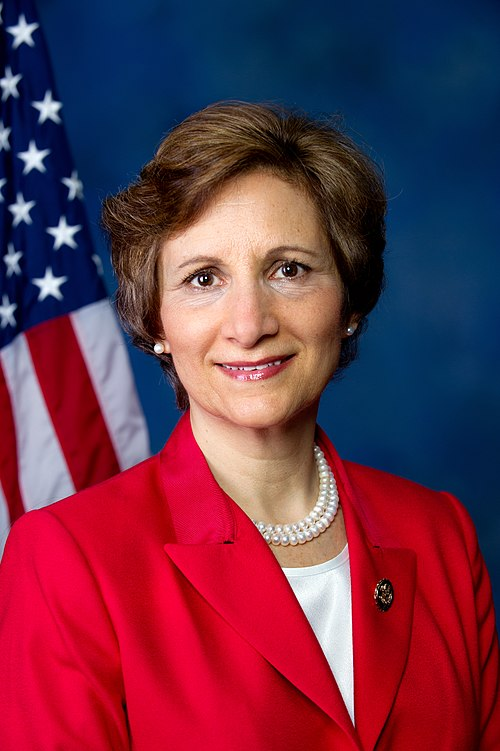

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 27, 2025 | Introduced in House |

| Feb. 27, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Oversight and Government Reform, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.