S. 1310: No Tax Breaks for Union Busting (NTBUB) Act

The "No Tax Breaks for Union Busting Act" (NTBUB) aims to amend the Internal Revenue Code to end tax deductions for businesses that attempt to influence their employees regarding labor organizations and collective bargaining. The bill seeks to align the treatment of such employer spending with similar political expenditures, which are not tax-deductible.

Key Provisions

- Denial of Tax Deductions: The bill specifies that expenditures made by companies to influence employee decisions about forming or joining labor organizations will not be eligible for tax deductions.

- Influence on Labor Organizations: It defines "attempts to influence employees" broadly, including any spending aimed at swaying employee opinions on labor organizations or associated activities.

- Reporting Requirements: Companies engaging in these influence activities must report expenditures on their tax returns, and failure to do so may result in penalties.

- Definitions: The bill lays out definitions for labor organizations and related activities, which include labor disputes, collective actions, and elections related to labor organizations.

- Exceptions to Deductions: Certain types of communications and consultations, such as those directly with employee representatives or for legally mandated information sharing, will not be subject to this denial of deductions.

- Penalties for Non-compliance: Employers who do not comply with the reporting requirements may face penalties, which could be substantial depending on the size of the company.

Findings

The bill states that, despite existing laws protecting workers' rights to organize, many companies frequently engage in practices that can interfere with this right. These practices may include unfair labor practices, intimidation, and heavy spending on consulting services to influence employee choices regarding unionization. The bill's authors argue that this culture of influence undermines the goals of collective bargaining and worker representation.

Effective Date

This legislation is proposed to take effect for expenditures made in taxable years beginning 240 days after enactment.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

29 bill sponsors

-

TrackBen Ray Lujan

Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

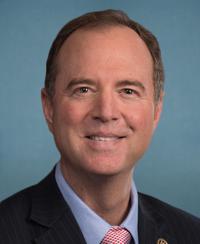

TrackAdam B. Schiff

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackElizabeth Warren

Co-Sponsor

-

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 04, 2025 | Introduced in Senate |

| Apr. 04, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.