Congress Trading Dashboard

The Stock Trading on Congressional Knowledge Act requires U.S. Senators and U.S. Representatives to publicly file and disclose any financial transaction within 45 days of its occurrence. We download those disclosures, parse them for stock trades, fetch the stock's performance in the time following the transaction, and calculate each politician's cumulative return from their trades.

MorePolitician Search

View Congress trading activity by:

Stock Search

View trading activity in Congress involving:

Recent Trades - U.S. Congress

Click on a trade for more details

Estimated excess return of the underlying stock since the transaction

Congress Long-Short Strategy

This strategy tracks the performance of stocks that have been purchased or sold by members of U.S. Congress (or their family). It takes a long position in stocks that have been purchased, and a short position in stocks which have been sold. This strategy is weighted based on the reported size of the transactions and employs leverage with 130% long exposure and 30% short exposure, with weekly rebalancing.

Backtest Start Date: 2020-04-01Key Metrics

+ Show Full MetricsReturn (1d)

-5.14%Return (30d)

-15.01%Return (1y)

-5.13%CAGR (Total)

30.95%Max Drawdown

-24.40%Beta

1.13Alpha

0.09Sharpe Ratio

0.868Win Rate

50.90%Average Win

0.32%Average Loss

-0.20%Annual Volatility

5.99%Annual Std Dev

0.24Information Ratio

0.57Treynor Ratio

0.19Total Trades

4599Metrics Definitions

-

Alpha

Measures a portfolio's risk-adjusted performance against that of its benchmark

Learn More -

Annual Standard Deviation

Measures how much the portfolio's total return varies from its mean or average.

Learn More -

Annual Volatility

A statistical measure of the dispersion of returns for the portfolio.

Learn More -

Average Win

The average return (%) for trades that resulted in a positive return.

-

Average Loss

The average return (%) for trades that resulted in a negative return.

-

Beta

A measure of the volatility of the portfolio compared to the market as a whole.

Learn More -

CAGR

CAGR (Compounded Annual Growth Rate), is the historical annualized rate of return for an investment strategy, throughout the backtest period.

Learn More -

Information Ratio

A measurement of portfolio returns beyond the returns of its benchmark compared to the volatility of those returns.

Learn More -

Max Drawdown

the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained.

Learn More -

Sharpe Ratio

The Sharpe Ratio is a measure of historical risk-adjusted return, which quantifies the amount of return that an investor received per unit of risk.

Learn More -

Total Trades

The total number of trades made by this strategy.

-

Treynor Ratio

Attempts to measure how successful an investment is in providing compensation to investors for taking on investment risk.

Learn More -

Win Rate

The percentage of total trades that resulted in a positive return.

Sign up for Quiver Strategies to see live holdings and portfolio insights for the Congress Long-Short Strategy

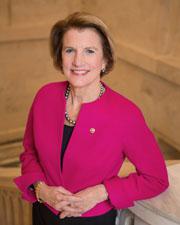

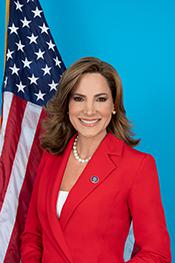

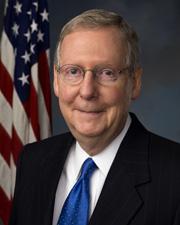

Most Active Congressional Traders - Last Year

Click on a politician for more details

Highest Net Worth Congressmembers

Click on a politician for more net worth details

|

|

Politician

|

Current Net Worth

|

|---|

Note that these are only rough estimates, and the data may be inaccurate or incomplete. This estimate does not include the value of the individual's primary residence, or any outstanding liabilities. Estimates of the value of publicly traded holdings are updated on an hourly basis. Estimates of the value of private holdings are only updated on an annual basis.