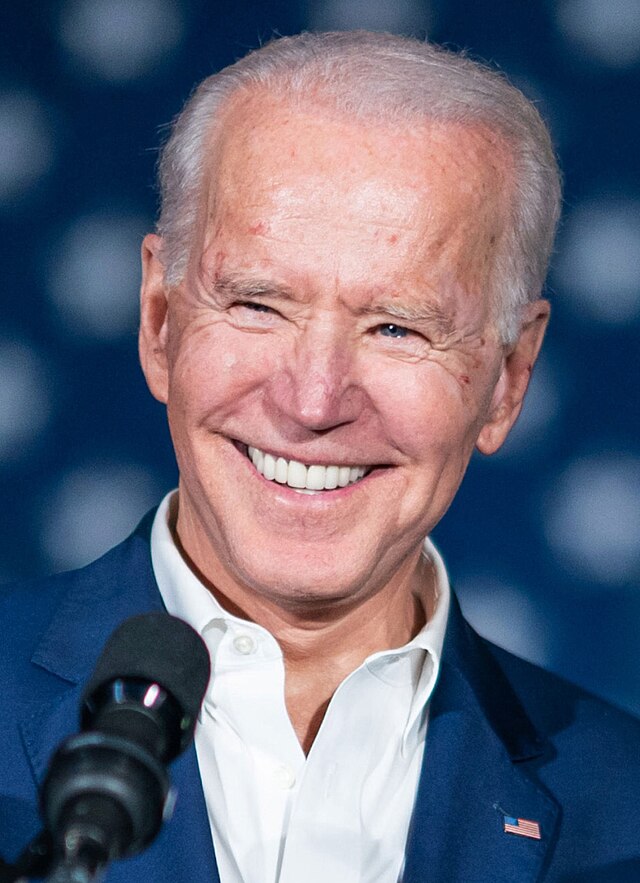

President Biden is reportedly close to blocking Nippon Steel’s (X) proposed $14.9 billion acquisition of U.S. Steel, citing national security concerns. The deal faces growing bipartisan opposition, including from Vice President Harris, who advocates for keeping U.S. Steel American-owned. U.S. Steel has warned that failing to secure the merger could lead to job losses and potential relocation of its headquarters from Pennsylvania. The move to block the deal may strain U.S.-Japan relations and is being closely watched by political and economic stakeholders.

U.S. Steel has expressed concerns over the potential failure of the merger, warning that it would pivot away from its blast furnace facilities, risking thousands of union jobs. Meanwhile, Nippon Steel plans to invest over $2.7 billion in U.S. steel facilities to support union-represented jobs, highlighting the strategic importance of the deal for both companies.

Market Overview:- Biden is expected to block Nippon Steel's $14.9 billion acquisition of U.S. Steel.

- U.S. Steel warned of job losses and potential headquarters relocation if the deal falls through.

- Shares of U.S. Steel dropped 17.5% following the news.

- The acquisition has bipartisan political opposition, including from Vice President Harris.

- U.S. Steel’s CEO warns of significant consequences for union jobs and facilities.

- Nippon Steel has committed $2.7 billion to invest in union-represented U.S. facilities.

- A decision from President Biden is expected later this week.

- The deal could impact U.S.-Japan relations and national security considerations.

- The outcome will shape future regulatory reviews of foreign acquisitions in the U.S. steel industry.

The impending decision on the Nippon-U.S. Steel merger will have profound implications for the U.S. steel industry and broader trade relations. With job security and political stakes high, the outcome is likely to set a precedent for how future mergers in strategic industries are handled.

The debate highlights concerns over foreign ownership in critical sectors, particularly with national security at the forefront. As the decision looms, both economic and geopolitical factors are at play, shaping the future landscape of the U.S. steel industry.