Former President Donald Trump’s media company, Trump Media & Technology Group (TMTG), is making waves in the stock market after a volatile campaign season. DJT, which holds the social media platform Truth Social, saw unprecedented fluctuations around the 2024 U.S. Presidential election, culminating in record-breaking movements. Trades of DJT were halted twice on Election Day due to high volatility.

Before the election, we spotlighted a trading strategy for Trump Media and Technology stock (DJT) which follows election odds on the betting site Polymarket. With the election called, we can now paint a broader picture of how DJT stock volatility shifted during the months preceding November 5th. On Election Day, DJT stock surged by 5.9% in the morning, only to plummet over 20% later in the day, triggering two temporary halts in trading due to excessive volatility.

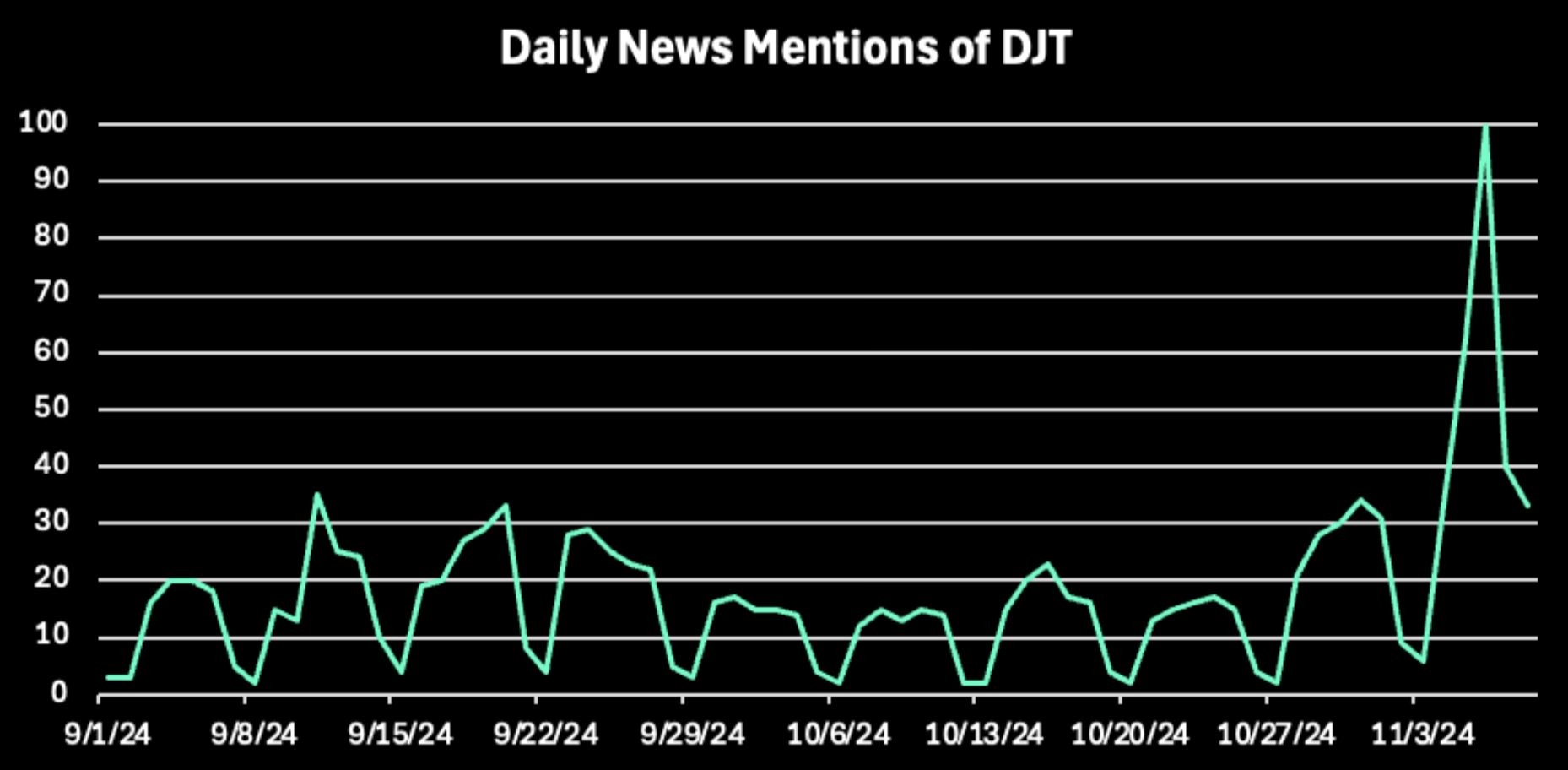

Despite these sharp swings, DJT ended the day with a slight 1% loss before rebounding over 10% in after-hours trading as election results channelled in. News and forum coverage of DJT mirrored this turbulence. DJT’s performance received heightened attention across all platforms.

The larger question now is whether trading strategies based on election data paid off.

Tracking the Donor Companies

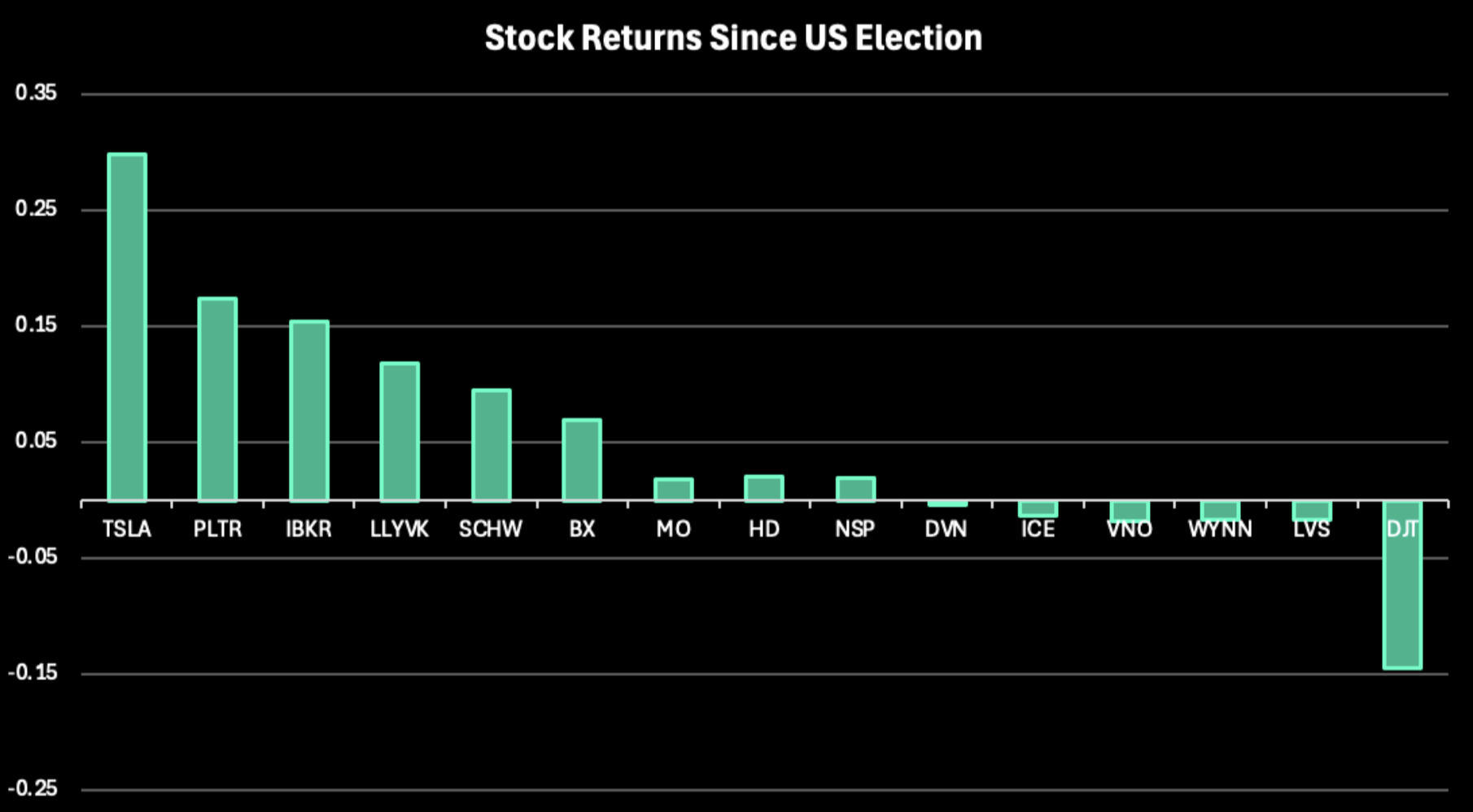

Prior to the election, we issued an announcement highlighting our new strategies to track Trump and Harris donor companies. These strategies aimed to measure if donor companies for one candidate outperformed those for the other as election results played out. Analyzing these holdings, preliminary data suggests Trump donor companies have generally outperformed those backing Harris, with notable gains in sectors closely associated with Trump’s platform.

Stocks held in the trading strategy for Trump include Tesla, owned by donor Elon Musk, as well as Charles Schwab ($SCHW) and Trump Media and Technology Group ($DJT). The Trump-affiliated stocks have benefitted from increased investor confidence, as expectations of favorable policies influence trading volumes.

Since the election, Trump-affiliated stocks have increased 5% on average, outpacing the S&P 500 on average by nearly 2%. The biggest winners have been Tesla, Palantir ($PLTR), and Interactive Brokers ($IBKR). Surprisingly, $DJT has been the biggest loser and has fallen considerably since the election.

Looking Closer at DJT Trades

A previous investigation by Quiver Quantitative studied whether DJT is a lagging or leading indicator of election odds, with evidence of the former. DJT’s performance appeared to react to changes in election odds on the betting platform Polymarket, rather than driving changes. The strategy was as follows:

- If Trump’s election odds rose, short DJT. - If Trump’s election odds fell, buy DJT.

This approach yielded a 10% return over three months leading up to the election, demonstrating how predictive market trends may be leveraged in tandem with DJT’s performance as election momentum shifted.

However, our new estimates for the entire length of the election campaign indicate that both profit and loss margins rose in the last two weeks of campaigning.

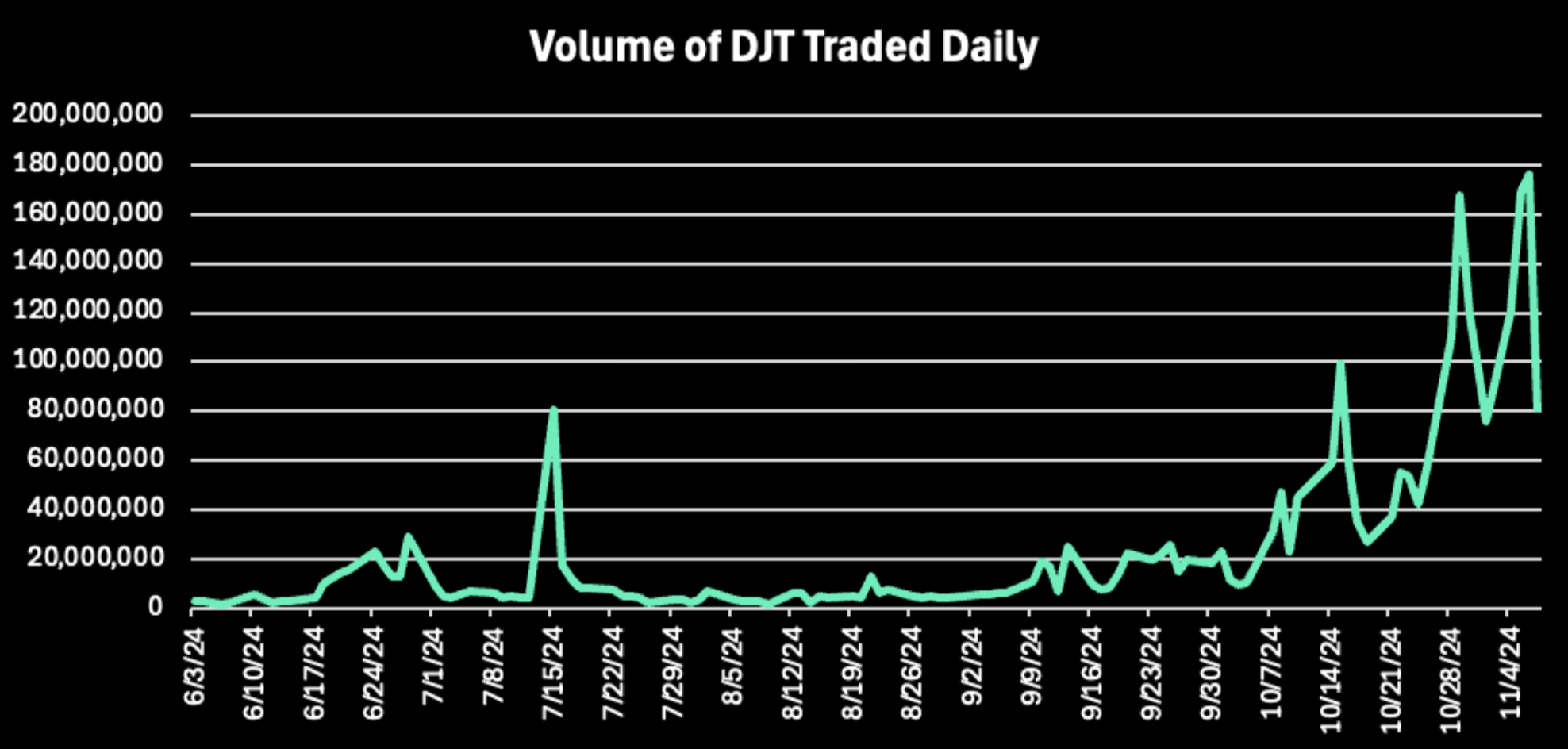

Both cumulative returns and volatility rose in October as trading volumes soared.

Trump Media and Technology ($DJT) stock saw record trading volumes in the week before the election as fluctuations in price increased in frequency.

Running our strategy for the entirety of the campaign until the election, the cumulative return reached 10.5% on the day of the election. This was following a dip in the three days before the election. The highest return for the strategy was on October 29th at 12.3% before dropping over 20% the following day.

Our updated understanding of a DJT trading strategy using Polymarket odds indicates profitability over the pre-election period. However, the post-election stock price dip in DJT has been surprising – perhaps a sign that $DJT owners have been moving to other assets that could benefit from a Trump presidency.