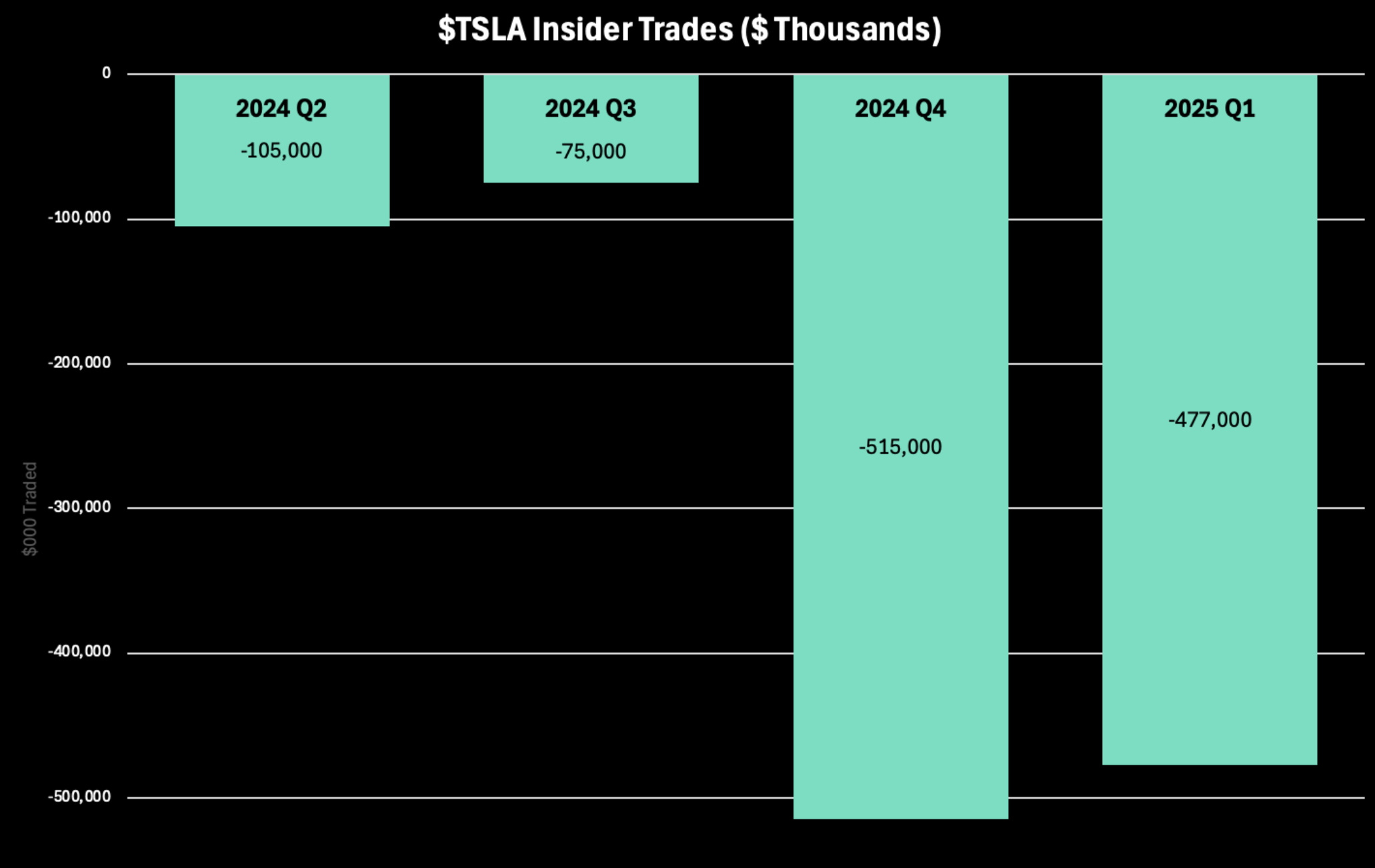

Elon Musk is telling Tesla employees to “hang onto your stock”. Tariffs and shifting EV policies are hitting Tesla hard, but Musk's political role as head of the Department of Government Efficiency (DOGE) is another factor spooking investors. $TSLA shares have fallen 8% in March and 40% since the beginning of the year. Meanwhile, insider traders sold nearly $500,000 worth of stock in Q1 2025, while Congress members dumped over $100,000 in February and March.

Reasons for this shift in Tesla’s fortunes are abundant. Foremost — President Trump’s newly-appointed tariffs are sending shocks across all US manufacturers. Tesla is currently lobbying these new tariffs, disclosing $190k of lobbying spend on the issue in January. In a letter to U.S. Trade Representative Jamieson Greer, the company urged officials to “consider the downstream impacts” of the import restrictions. Supply chain disruptions will also drive up production costs, putting pressure on Tesla’s profit margins. The company relies on parts from Canada, Mexico, and China—all affected by President Trump’s tariffs.

But Tesla's global sales are also slipping, especially in Europe and China. Competition is mounting: Ford, GM, and Volkswagen are chipping away at Tesla's dominance, while Chinese automakers are eating up demand for Tesla in Asia. In Germany, a large market for electric cars, Tesla vehicle sales have dropped 76% since February 2024.

EVs have also become a political hot shot: Trump, a longtime skeptic of clean energy, now claims he is buying a “brand new Tesla”. Meanwhile, he accuses left-wing consumers of boycotting the stock.

Musk himself remains a divisive figure. His vocal criticism of the Biden administration and engagement with Republican lawmakers have alienated some traditional Tesla buyers, whilst the energy-forward agenda of Tesla does not prove palatable for a conservative congress. In January President Trump reversed Biden’s 2021 executive order initiating electric vehicle adoption — another sore point for Musk and $TSLA.

But Tesla isn’t the only automaker struggling. BMW and other industry players report weak Q1 earnings as buyers hesitate in a progressively uncertain market. Higher interest rates have made auto loans more expensive, further slowing EV adoption.

Looking ahead, Tesla’s ability to separate its stock valuation from Musk’s government involvement will be important for establishing greater certainty — for both sales and the stock price. How the stock may weather the storm of new tariffs is also still unknown, as are the impacts of the tariffs on consumer demand. Though Musk urges employees to keep their stock, broader insider trends suggest lingering doubt about the company’s forecasts.